In honor of National Consumer Protection Week (March 5-11), I’d like to make you aware of a new scam making its way across the nation. Scammers are posing as fraud investigators.

This happened to me just yesterday! Well… not for real. Fortunately, my caller was legitimate. But its timing caused concern as it came while I was in the middle working on this very blog post!

Be wary if you get a call from a credit card “fraud investigator.” The caller you’re speaking with may actually be trying to defraud you. Here’s how it works:

You get a call claiming to be from Visa, MasterCard, or even your bank’s fraud department. The “representative” says they have detected suspicious activity on your card and need to verify a transaction.

According to experts, the caller may ask something like, “Did you make an overseas purchase in the amount of $478?” When you deny the charge ever took place, you’re told they will cancel the transaction and open up a fraud investigation. Unknowingly, you say thanks and sigh in relief.

But… Keep your radar up because this is where the plot thickens. In order to proceed, says the caller, they will need to verify that “you are in procession of your card.” What they really want is that three digit CVV security number on the back of your card!

To sound authentic, the caller will typically ask for both the last four digits of your card number, and the security code on the back.

Steve Weisman is one of the country’s leading experts on scams and identify theft. His book, “The Truth about Avoiding Scams” is one of the most important books ever written about scams and he is a regular contributor to major media outlets. He stresses how very important that security code is to preventing credit card theft. And that’s just the tip of the iceberg.

In a recent column in USA Today, Weisman says, “There is nothing you can do to totally protect yourself from identity theft, partly because much identify theft occurs due to poor security at places with which you do business that fail to adequately protect your personal information. But there are many basic steps you can take that can dramatically improve your chances of avoiding identity theft.” You can read the full article here.

Further, if you get hit with this scam, the Better Business Bureau says it’s very possible the scammer already has your name, address, and credit card number from a data breach. Now all they need to use your card fraudulently is the security code on the back.

Specifically, the BBB warns:

Specifically, the BBB warns:

- Never give your credit card number or the security code to someone who has called you.

- If you get a call from the fraud department of your credit card, ask them to give you information to verify that they are the real deal. For instance, you can ask for the last several transactions and the amounts.

- If you have any doubts concerning the authenticity of the call, hang up, call the customer service number on the back of your credit card and follow the instructions for reporting fraud.

- Check your credit card statements online frequently. Don’t wait for your monthly statement.

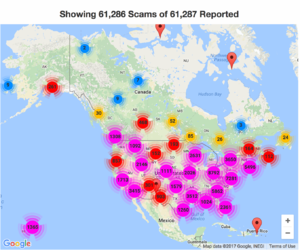

Finally, if you get one of these calls, report it to the BBB using their ScamTracker.